https://fs.blog/second-order-thinking/

The best way to examine the long-term consequences of our decisions is to think things through. This is called use second-order thinking.

Second order thinkers ask themselves the question “And then what?” First-level thinking looks similar. Everyone reaches the same conclusions. This is where things get interesting. The road to out-thinking people can’t come from first-order thinking. It must come from second-order thinking. Extraordinary performance comes from seeing things that other people can’t see.

Improving Your Ability To Think

Here are some ways to put second-order thinking into practice today.

- Always ask yourself, “And then what?”

- Think across time — What do the consequences look like in 10 minutes? 10 months? 10 Years?

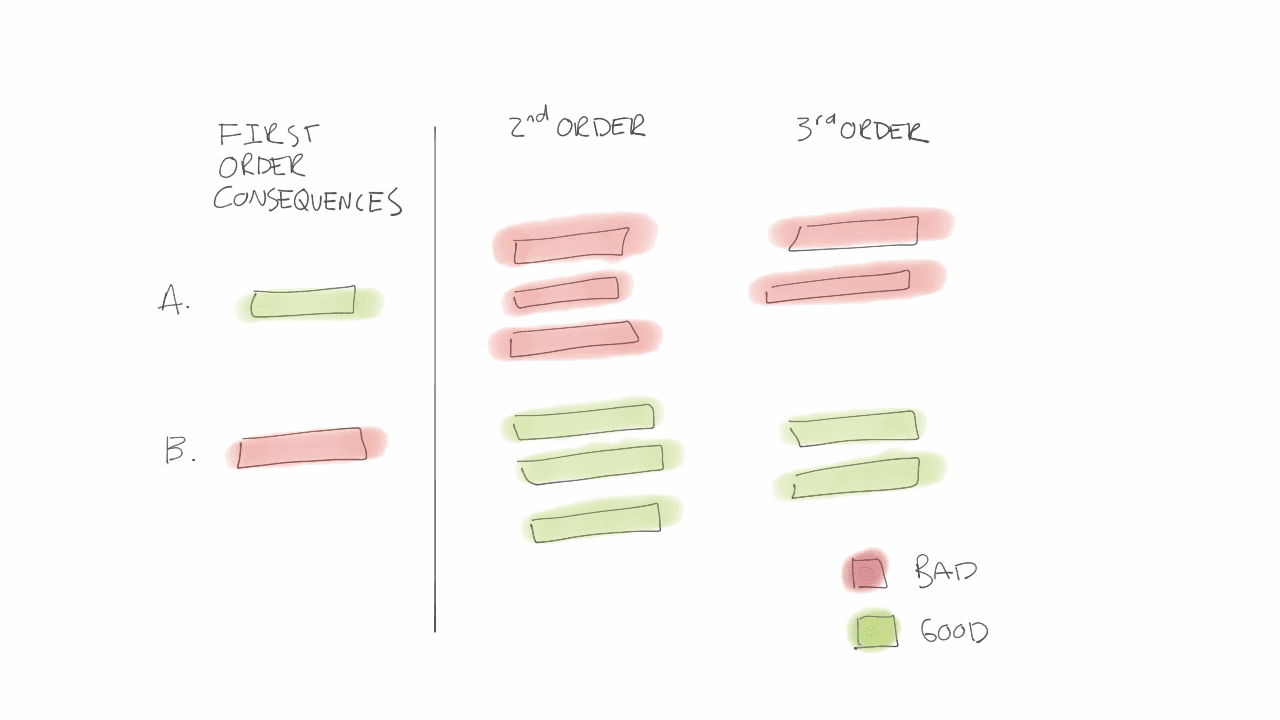

- Create templates like the second image above with 1st, 2nd, and 3rd order consequences. Identify your decision, think it through, and write down the consequences. If you review these regularly you’ll be able to help calibrate your thinking.

- If you’re using this to think about business decisions, ask yourself how important parts of the ecosystem are likely to respond. How will employees deal with this? What will my competitors likely do? What about my suppliers? What about the regulators? Often, the answer will be little to no impact, but you want to understand the immediate and second-order consequences before you make the decision.

The Most Important Thing by Howard Marks – Chapter on “Second-Level Thinking” https://dl.najafi8.ir/dl/Library/book/%5BHoward_Marks%5D_The_most_important_thing_uncommon_.pdf

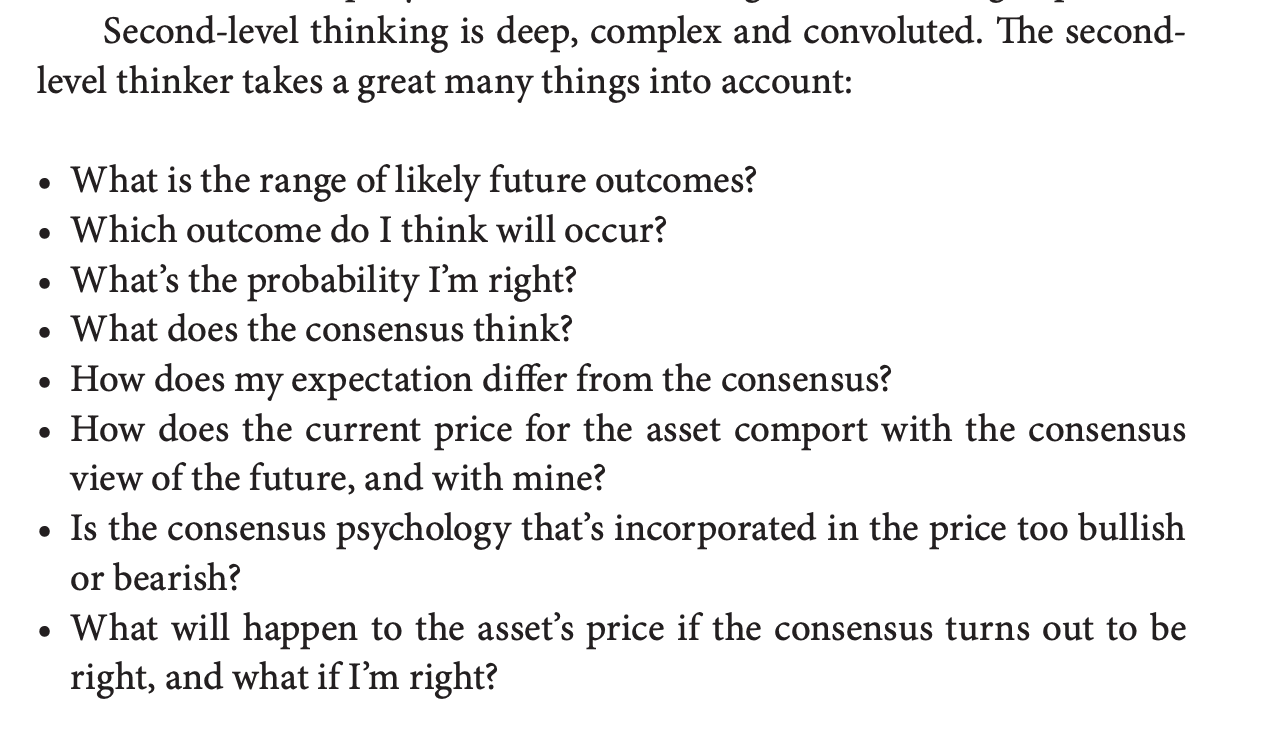

First- level thinkers think the same way other fi rst- level thinkers do about the same things, and they generally reach the same conclusions. By defi nition, this can’t be the route to superior results. All investors can’t beat the market since, collectively, they are the market.

Before trying to compete in the zero- sum world of investing, you must ask yourself whether you have good reason to expect to be in the top half. To outperform the average investor, you have to be able to outthink the consensus. Are you capable of doing so? What makes you think so?

Different and better: that’s a pretty good description of second- level thinking.

Reflection: I really like the image above, it’s very helpful to draw the consequences, great trick!